|

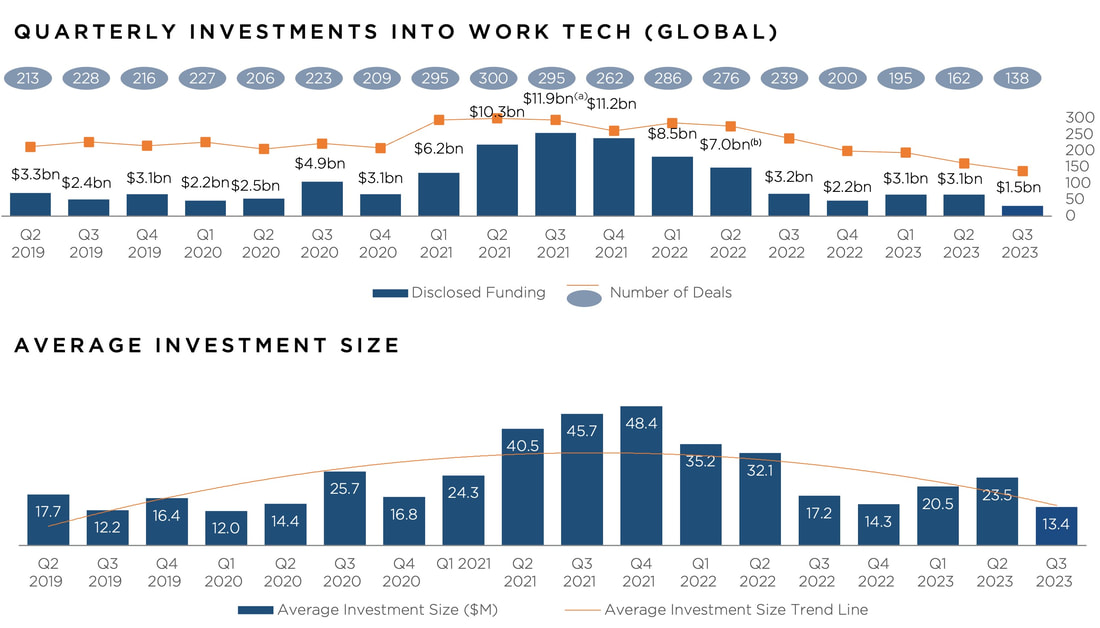

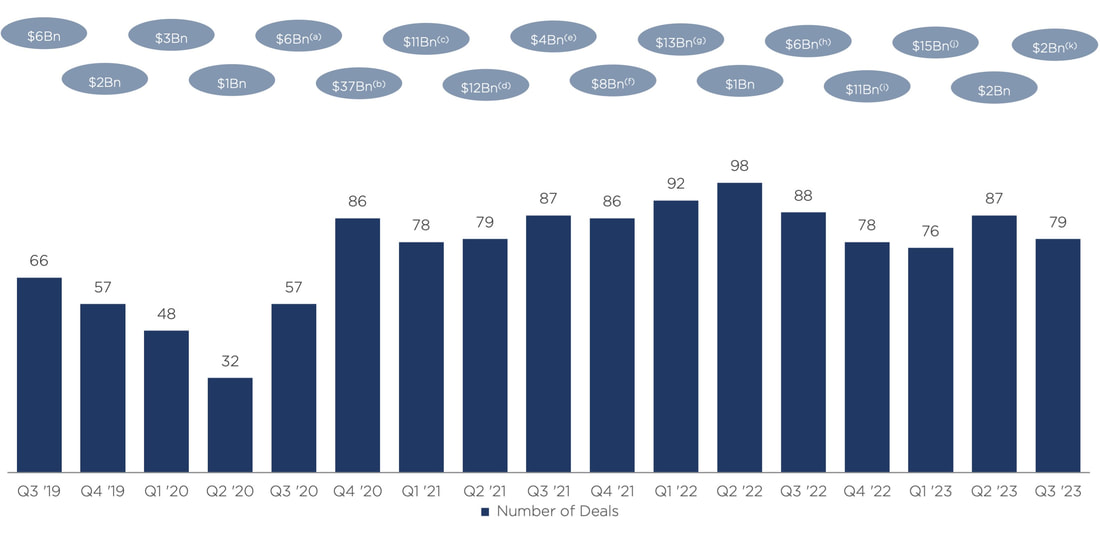

The fundraising environment remained difficult in Q3 2023, with just $1.5 billion raised across 138 rounds in the quarter. This is the lowest activity level since 2018, and is a continuation of a steady slowdown that started in early 2022. Average investment size during the quarter remained broadly in line with historical averages, excluding the post-Covid boom, another indication that we are in the midst of a broad-based activity decline. However, M&A activity remained surprisingly resilient, despite the broader macro sentiment. 79 transactions were announced in Q3, which is very much in line with recent levels. Private Equity firms in particular have significant capital to deploy and are actively pursuing both platform acquisitions and bolt-on’s for their portfolio companies. Corporate acquirers also remain active, although they tend to be quite disciplined when it comes to buy vs. build decisions. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed