Work Tech vendors have been investing in AI for years, yet generative AI will disrupt the Future of Work more quickly than people anticipate, and the impact will be much more pronounced. In this report we discuss why and how Generative AI will fundamentally change the competitive landscape, and why Work Tech vendors will need to establish a different competitive moat. We dive into the state of the Work Tech market, Generative AI use cases, early product releases, risks, limitations, as well as implications for M&A and VC funding. The report also looks at the impact of inflation, layoffs, lack of VC funding and tightening budgets on Work Tech vendors, and the outlook for M&A and fundraising. Current risks and limitations notwithstanding, the AI genie is now out of the bottle. As with other paradigm-shifting innovations, like the rapid democratization of the Internet following the release of the first Mosaic web browser, all vendors should take note and carefully assess the impact Generative AI is likely to have on their business. Following a very strong recovery in 2021 and an initial softening in 1Q 2022, the HR Tech and broader Work Tech sectors are beginning to feel the impact of high inflation and uncertain macroeconomic outlook. In this context, the second quarter closed with mixed results:

Both in M&A and venture, there are two types of buyers / investors: those who take a “risk-off” approach across the board, and those who are more nuanced when assessing opportunities. Valuation expectations between companies and buyers / investors diverged somewhat abruptly, particularly for businesses that have yet to feel any adverse impact to their operations. However, we are still at the beginning of what is likely to be a protracted battle against recessionary forces. We expect that the current sentiment dichotomy will be reflected more comprehensively in the figures of Q3 and Q4, before the level of impact on businesses gradually becomes clearer and viewpoints start to reconverge. The Work Tech sector’s outsized growth potential, coupled by its significant fragmentation, increased competition and continued innovation has already kicked-off a broad- based wave of M&A. The trend is clearly towards integrated product offerings that cater to a wide range of adjacent functional needs for clients of all sizes. In 2020 there were 177 transactions, with disclosed value of $45.5 billion. We call this the Great Consolidation because its trajectory indicates a reshaping of the Work Tech competitive landscape, with longer-term implications.

2020 is the year of consolidation for Open Banking API businesses When Visa first announced the acquisition of a little known fintech company called Plaid for an eye popping $5.3bn in January 2020, the deal attracted significant investor and strategic interest. Since then we have seen multiple acquisitions in the API space, including Galileo which was acquired for $1.2bn by SoFi in April. Mastercard, reeling from missing out on the acquisition of Plaid to Visa, went on to acquire another API provider Finicity for $860m ($985m including earn-outs) in June. Swedish API provider Tink raised €90m in December last year at a post-money valuation of €415m and boasted several well-known investors including PayPal. Since then, Tink has gone on to acquire three companies including financial API provider OpenWrks (Sep 2020) in the UK, which accounts for one third of the country's account aggregation volume.  Fintech firms continue to add new product lines catering to gig economy workers and to expand their offering, both organically and through M&A. Banks and lenders are leveraging Lending as a Service to surface their products and services on platforms outside of traditional banking channels. Companies that started with B2B2C models for gig platforms are now targeting the entire gig economy. The launch of Payments as a Service has increased speed to market and resulted in greater competition. This client briefing note describes how the gig economy is driving the next wave of fintech. In this April 2020 update, Venero provides an economic review of the potential macroeconomic shock, the impact it may have on HR Tech / Future of Work businesses, and the implications for fundraising and M&A.

Topics covered:

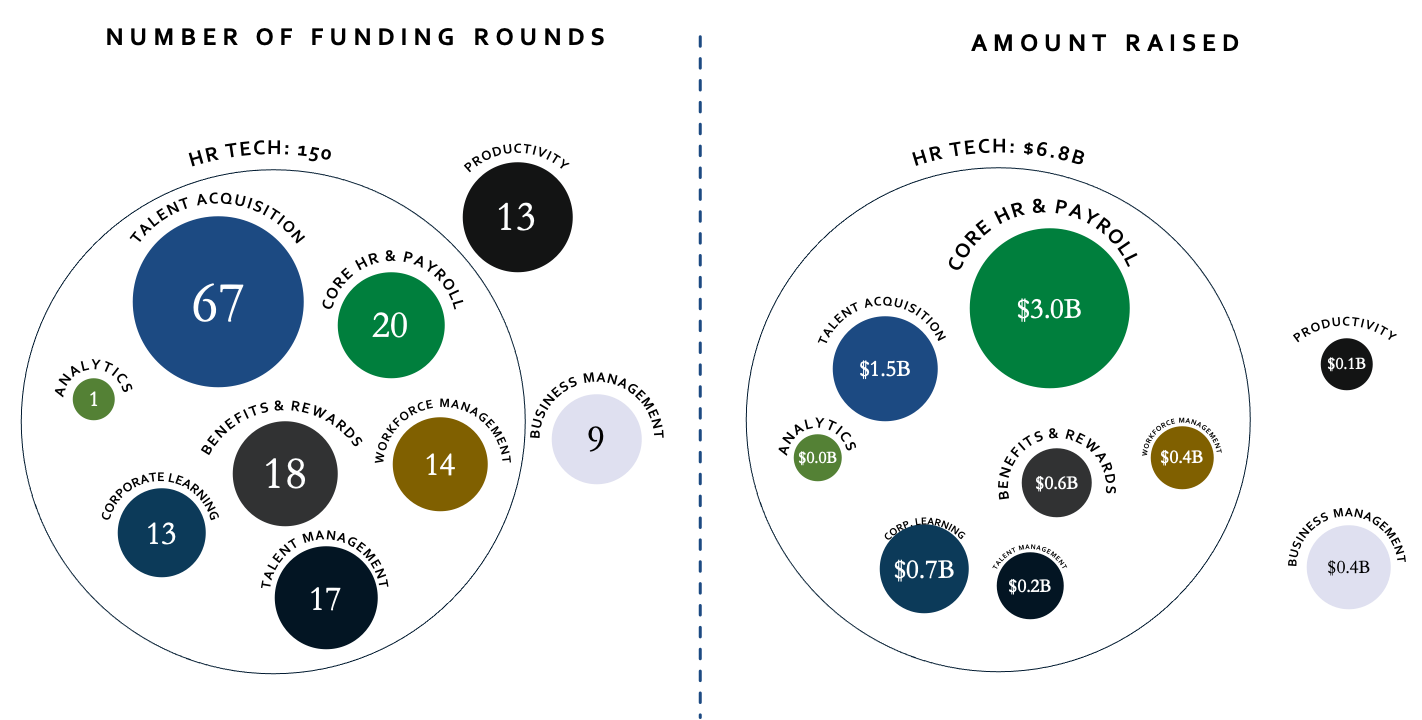

We are delighted to present our 2019 analysis of M&A and investment trends in the HR Tech sector. This is the second year in a row we release such a report, after the overwhelmingly positive reception of the inaugural publication. Similar to last year, in this report we share some of the insights and observations we have gathered from working with companies and investors in the Human Capital Management space over the last 12 months. We review the most prevalent M&A and investment themes, analyse notable transactions and highlight the factors that are likely to drive corporate finance activity for HR Tech businesses going forward. Below are the key takeaways. You can request the full report here. Client Briefing Note:Cybersecurity is a sector flush with fragmented technologies. M&A deal flow is underpinned by robust structural growth, transition to the Cloud, government regulations and sophisticated cyber breaches. In this context, small players with niche technologies are acquired by larger peers who need to expand their capabilities and scale their product offerings.

This briefing note looks at the main drivers of M&A activity in the cybersecurity space, reviews transaction volumes, the most active acquirers and trends such as vendor rationalization. It also explains the importance of an Advanced Security Operation Control as a driver for acquisitions and analyzes precedent transaction multiples and public trading valuations. Client Briefing Note:IBM’s announced acquisition of Red Hat in a deal with an enterprise value of roughly $34 billion at a hefty premium triggered a recovery in cloud stocks. The reason this particular transaction acted as such powerful a trigger is because it reinforced a pattern that the market has come to expect: transformational deals, outsized tech valuations and continued anxiety among the majors to remain competitive and perhaps even relevant.

This briefing note looks at the recent trends in 'cloud' M&A, the impact on acquisition valuation multiples and the expectations for further consolidation among cloud software companies in 2019. Client Briefing Note:Salesforce reported reported Q1 FY19 revenue growth of 25% YoY, consistent with its remarkable historical performance. The company reported double-digit growth in all relevant metrics, exceeded analyst expectations and company guidance, and raised expectations for future performance across the board. Growth is showing no signs of decelerating, despite the company surpassing $12bn in ARR.

This briefing note analyses the core pillars of Salesforce's performance, the company's latest acquisitions and the implications for Salesforce's growth strategy, competitive positioning and outlook. |

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed