|

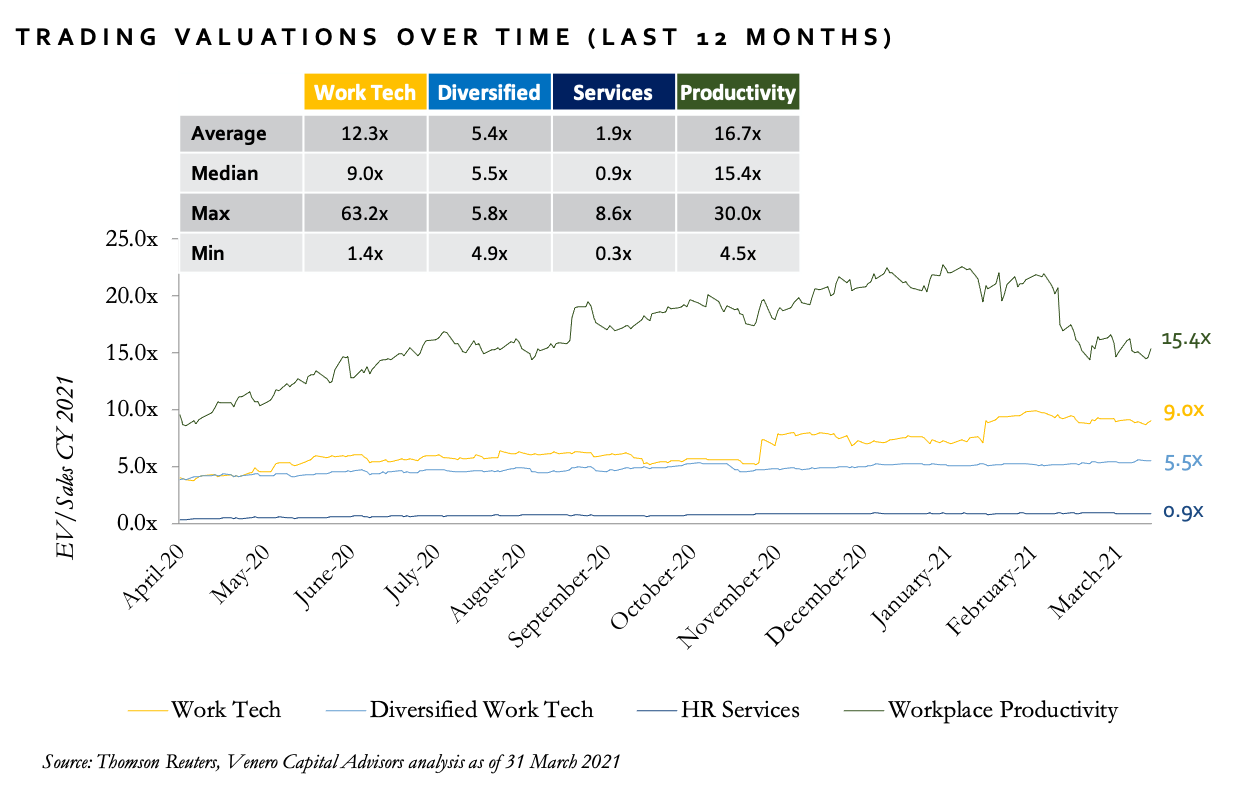

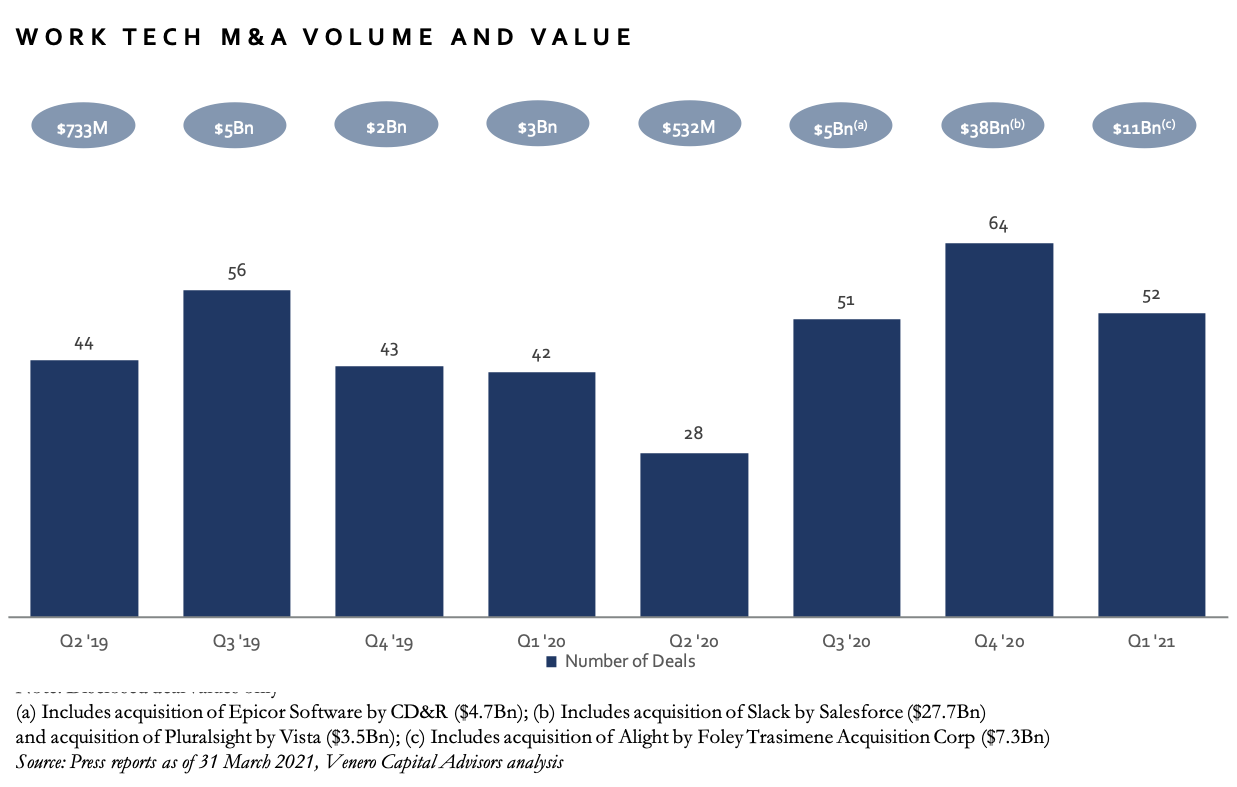

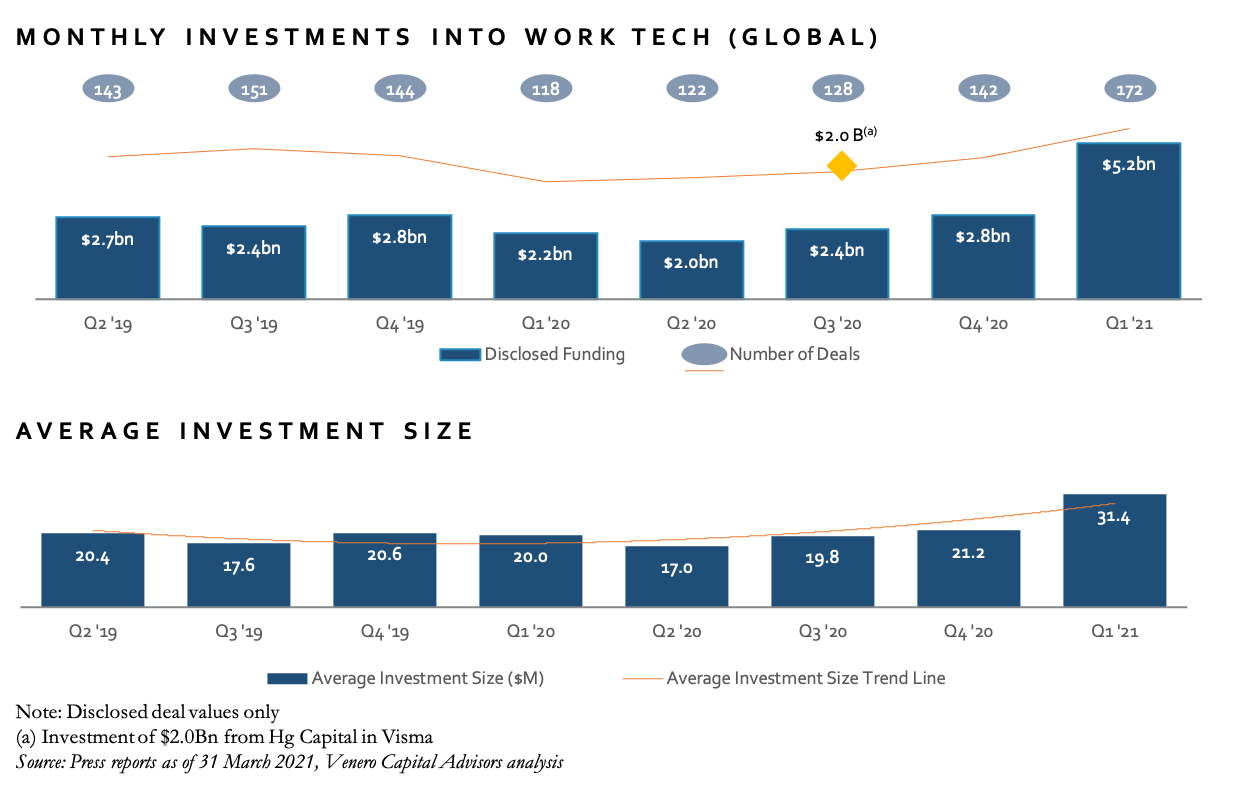

A record $5.2Bn was invested in Work Tech during 1Q 2021 across 172 deals – all-time high levels both in terms of volume and value. The average investment size continued to grow, reaching $31.4M vs. $21.2M in the previous quarter. In terms of M&A, several major vendors pursued acquisitions, taking advantage of market conditions. 52 acquisition were announced in total – a slight pullback compared to the peak of 4Q 2020 but still high compared to historical levels. In the public markets, median valuation multiples for pure Work Tech companies expanded 19% to 9.0x CY2021 revenue vs. the end of Q4 ‘20. Productivity businesses pulled back from their peak, contracting by 25% over the same period, while valuation multiples for Diversified Work Tech and HR Services remained broadly stable. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed