|

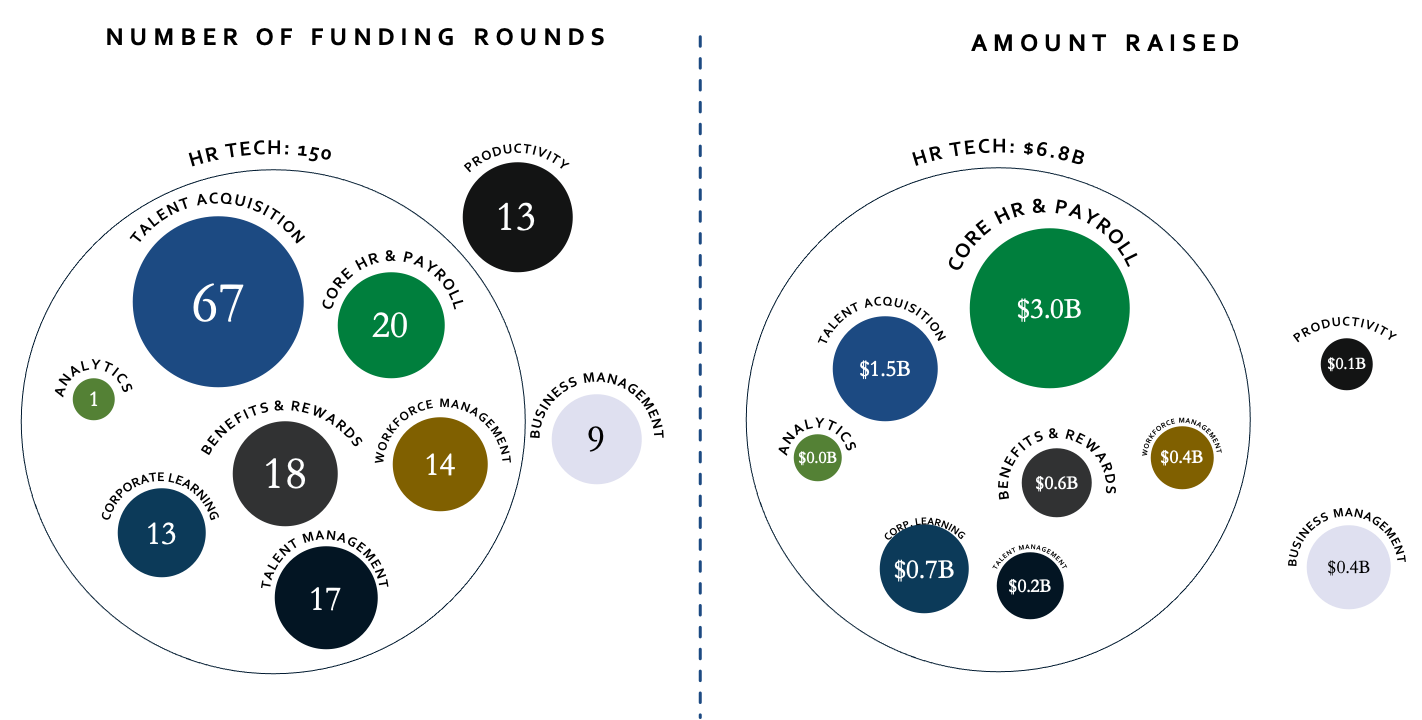

Following a very strong recovery in 2021 and an initial softening in 1Q 2022, the HR Tech and broader Work Tech sectors are beginning to feel the impact of high inflation and uncertain macroeconomic outlook. In this context, the second quarter closed with mixed results:

Both in M&A and venture, there are two types of buyers / investors: those who take a “risk-off” approach across the board, and those who are more nuanced when assessing opportunities. Valuation expectations between companies and buyers / investors diverged somewhat abruptly, particularly for businesses that have yet to feel any adverse impact to their operations. However, we are still at the beginning of what is likely to be a protracted battle against recessionary forces. We expect that the current sentiment dichotomy will be reflected more comprehensively in the figures of Q3 and Q4, before the level of impact on businesses gradually becomes clearer and viewpoints start to reconverge. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed