|

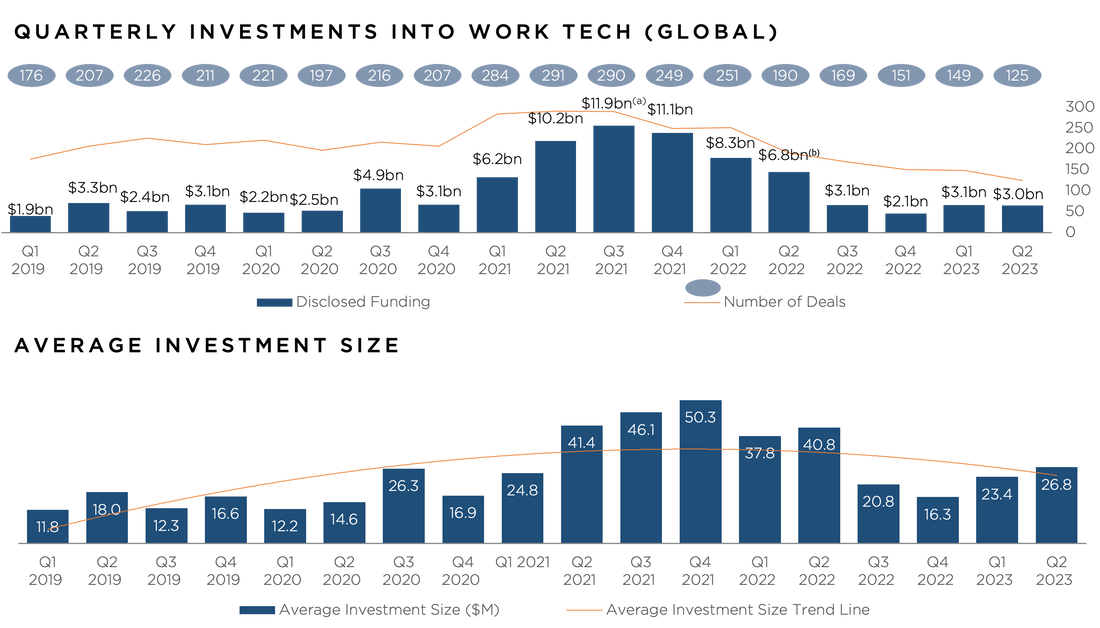

M&A activity held up surprising well during the first half of 2023, with 155 announced acquisitions. This is not far off the robust levels seen in the dealmaking boom of the 2021-2022 post-Covid era. Buyers have remained active, and valuations have shown signs of recovery after contracting by c. 35% last year. Growth remains the primary valuation driver for M&A. However, increasingly it is assessed in conjunction with capital efficiency, profitability, or with the potential for a business to achieve breakeven in the near term. Equity funding reached $6.1 billion in the first six months of the year, putting 2023 on track to be the third best year in terms of funding for the sector. However, this amount was invested across 274 transactions, which is a record low number of deals for the sector. What this implies is that investors are comfortable making larger bets on more mature Work Tech businesses. It is a sign of confidence that the addressable market for Work Tech continues to expand, and that later-stage vendors are well placed to capture sizeable parts of the wallet. Looking ahead, the macroeconomic outlook remains subdued but stable. Businesses are being more cautious with hiring and procurement decisions, which means that the desired slowdown is underway. Still, interest rates are likely to continue to rise in Europe and the US, as labor markets remain tight and inflation is above the central banks’ targets. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed