|

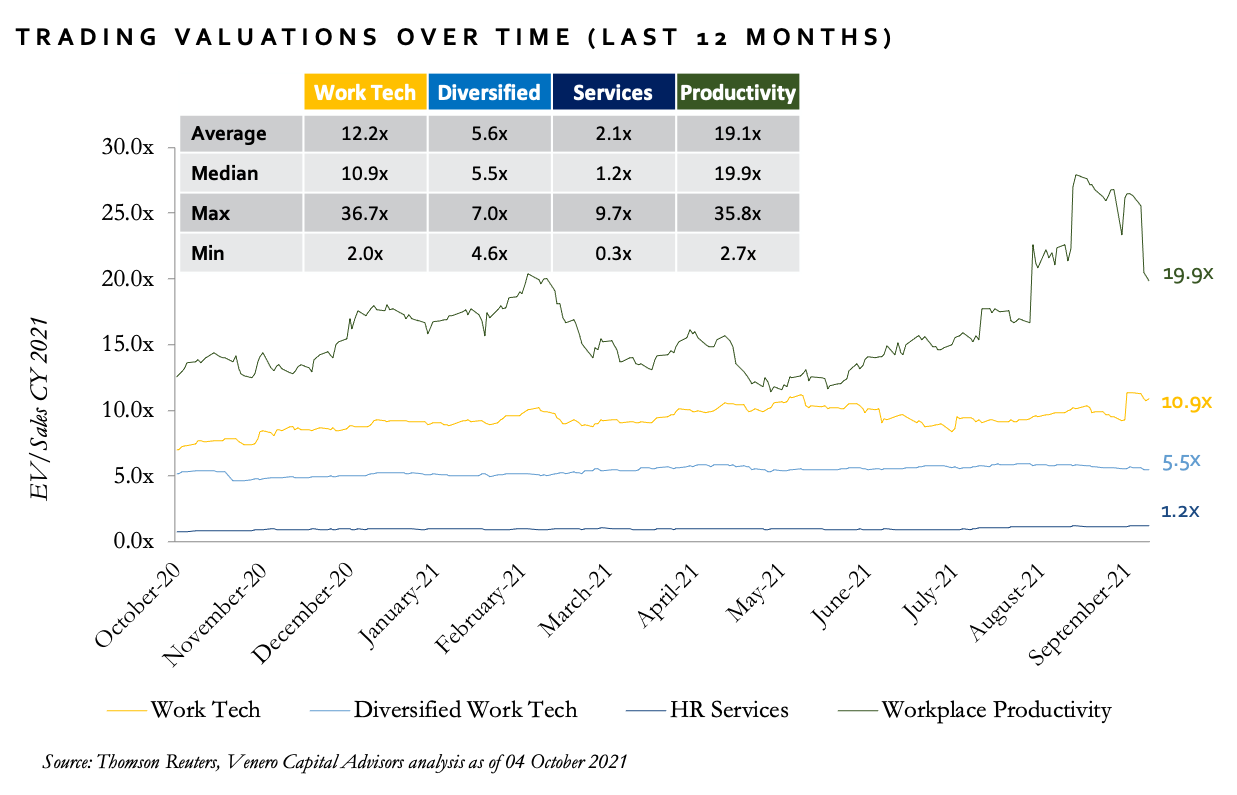

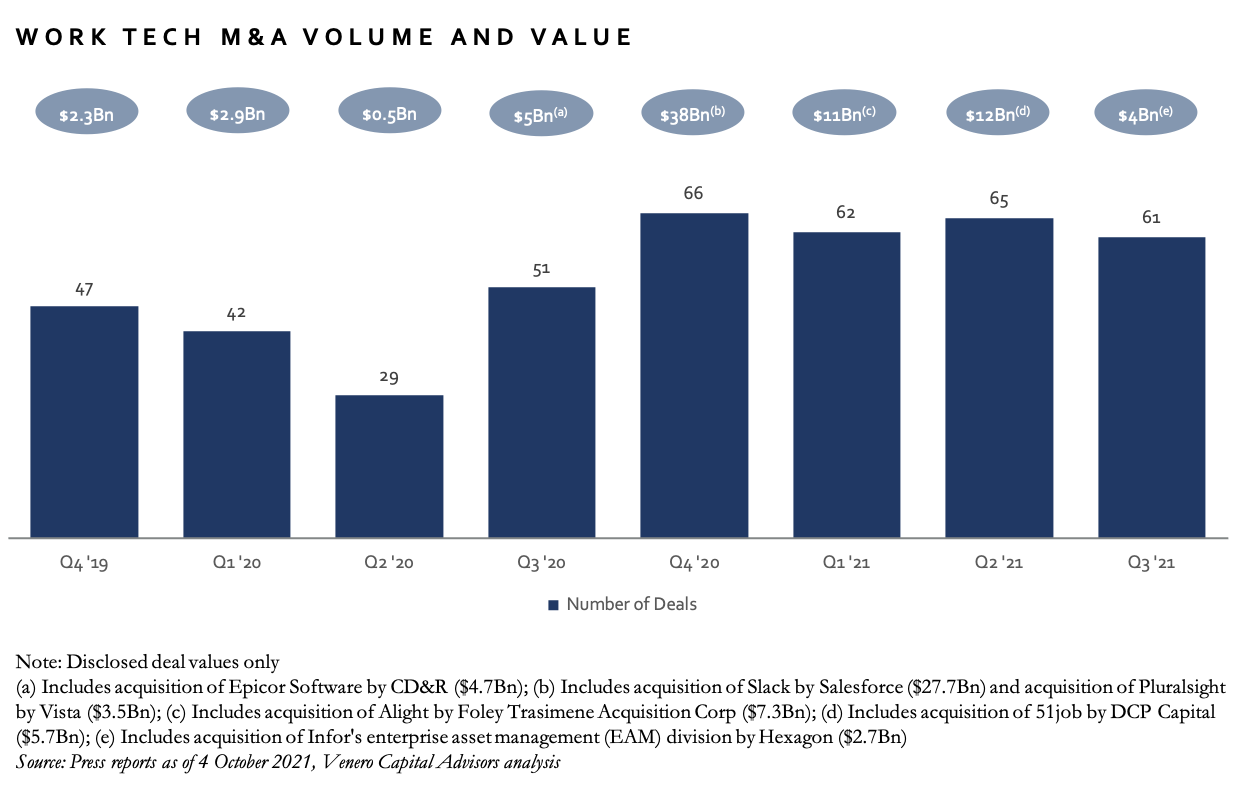

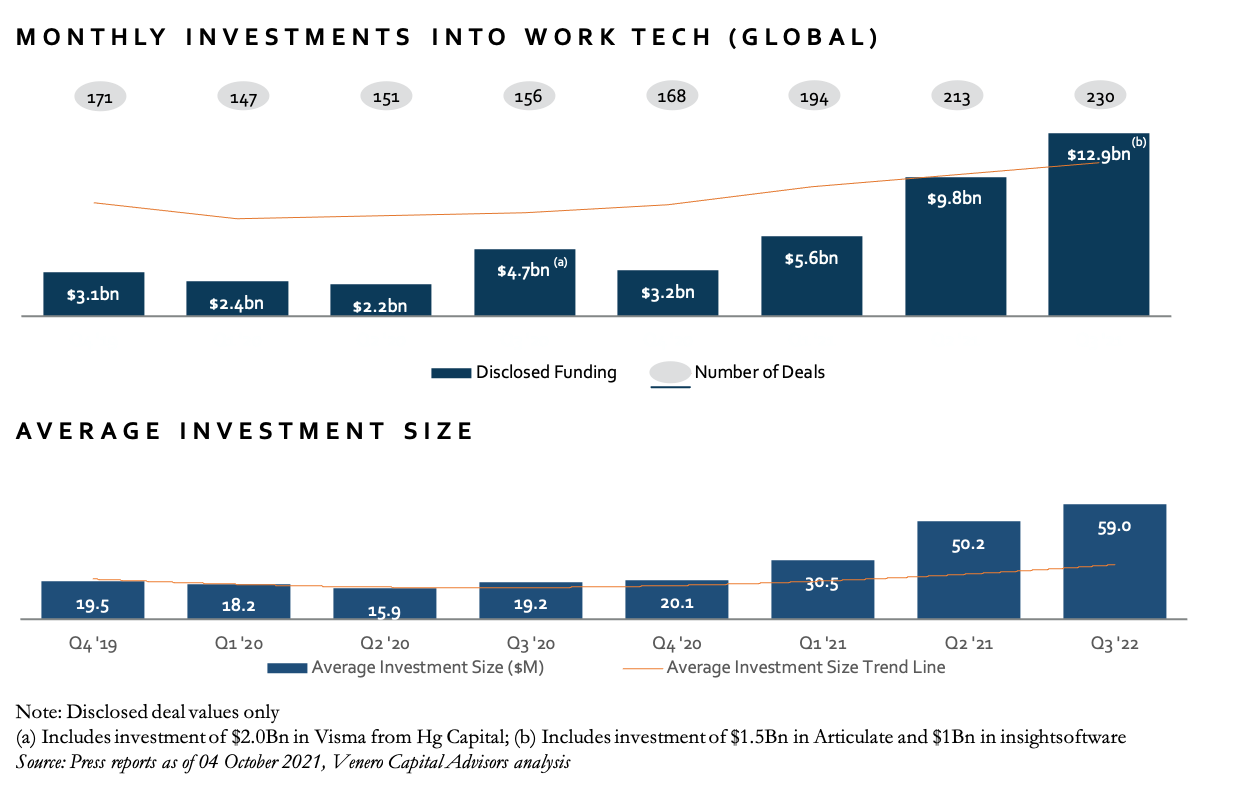

WorkTech is going from strength to strength, with $12.9 billion invested into the sector last quarter across 230 transactions. Average investment size continues to increase, driven by major investments such as $1.5 billion into Articulate (online training) and $1 billion into Visma (core business software). M&A activity remained elevated, with 61 transactions being announced – a slight decline compared to the previous three quarters but still well above 2020 and even 2019 levels. Major transactions this quarter included Cegid's acquisition of Talentsoft, Blackstone's acquisition of Simplilearn and Veritone's acquisition of Pandologic. Median trading valuation for WorkTech businesses expanded to 10.9x, driven by the successful IPO’s of Freshworks and Paycor. The median trading multiple for Productivity vendors was volatile, impacted primarily by Zoom and the IPO of Monday.com. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed