|

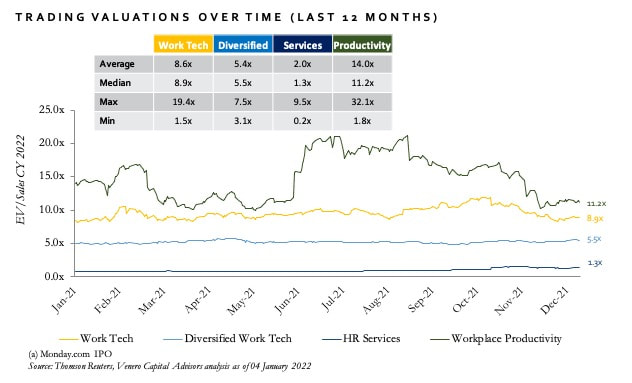

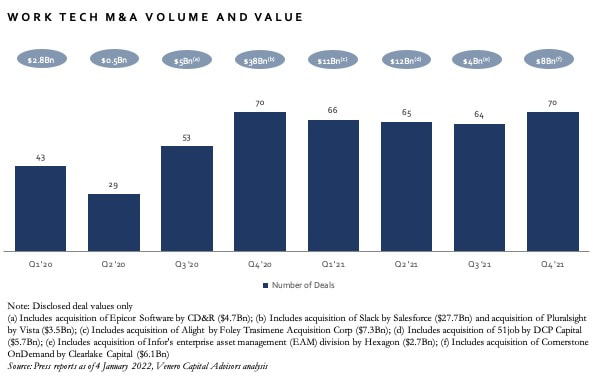

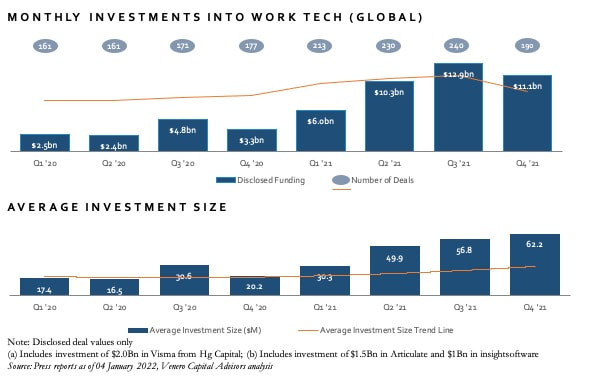

Valuation multiples for publicly-listed Workplace Productivity businesses contracted in Q4, in line with much of the broader technology sector. Median valuations for HR Services and Diversified WorkTech showed greater resilience, expanding by 28% and 13% respectively. In terms of M&A, 70 WorkTech acquisitions were announced, a c.9% increase compared to the previous quarter with significant interest in Talent Acquisition as well as Workforce Management assets. Private Equity was involved in c.7% of transactions. Investment volumes remained elevated, with more than $11.1Bn invested in the sector across 190 deals. The average investment size continued to grow, reaching $62.2M vs. $56.8M in the previous quarter. To receive M&A and capital raising insights, deal announcements, research reports and news from Venero Capital Advisors, register here.

Comments are closed.

|

|

Venero Capital Advisors offers tailored and independent investment banking services to businesses operating in HR Tech and the Future of Work sector. Our client relationships are built and carefully maintained on trust, discretion and dedication. We combine in-depth industry expertise with market leading advisory skills – delivered within a highly confidential and unconflicted framework.

Venero Capital Advisors Ltd. is authorised and regulated by the Financial Conduct Authority (the "FCA"), appearing on the FCA register under firm reference number 795179. © Copyright 2023 Venero Capital Advisors Ltd. |

RSS Feed

RSS Feed